SUMMARY

NFT Knox was created with the purpose of connecting blockchain technology and non-fungible tokens (NFTs) to real-world assets through utility. Essentially, NFT Knox securely stores valuable real-world assets and links each asset to a transferable and redeemable NFT. What makes our service unique is that it utilizes blockchain to facilitate quick and seamless transactions for product categories that are typically slow and cumbersome.

While NFTs have mostly been associated with digital art, our technology allows for the inclusion of physical items as well. This means that graded collectibles, commissioned paintings, and even high-end valuables can be accommodated. Traditional transactions involving real-world assets often come with risks such as damage, theft, authentication, and insurance, not to mention the time-consuming process of shipping. However, with NFT Knox, conducting transactions on authenticated and secure real-world assets is as easy and fast as sending an email.

ASSET-BACKED NFTs

NFT Knox is built around the idea of utility, specifically the value of linking physical assets with their digital representations. Non-fungible tokens (NFTs) provide a solution for representing these physical assets in a digital form. By combining the unique digital address of an NFT with the secure and transparent nature of blockchain technology, we ensure that the digital representation of a client's physical asset remains stable and reliable.

The use of NFT technology allows for innovation and creativity in representing any real-world element digitally. While the metaverse has gained attention for its digital benefits, the true excitement lies in the connection between the digital world and real life. NFT Knox is leading the way in developing technology that allows clients to access their valuable assets in both realms

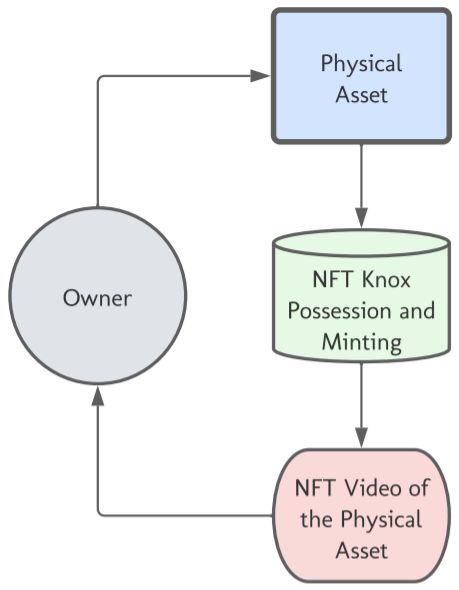

Through the process of minting, NFT Knox enables consensus verification of NFT ownership. This process involves creating a digital copy of a physical collectible or asset and recording it on the blockchain in the form of a high-resolution video or image. The immutable record on the blockchain serves as proof of ownership, eliminating the need for a single entity to grant authority.

NFT KNOX SECURITY

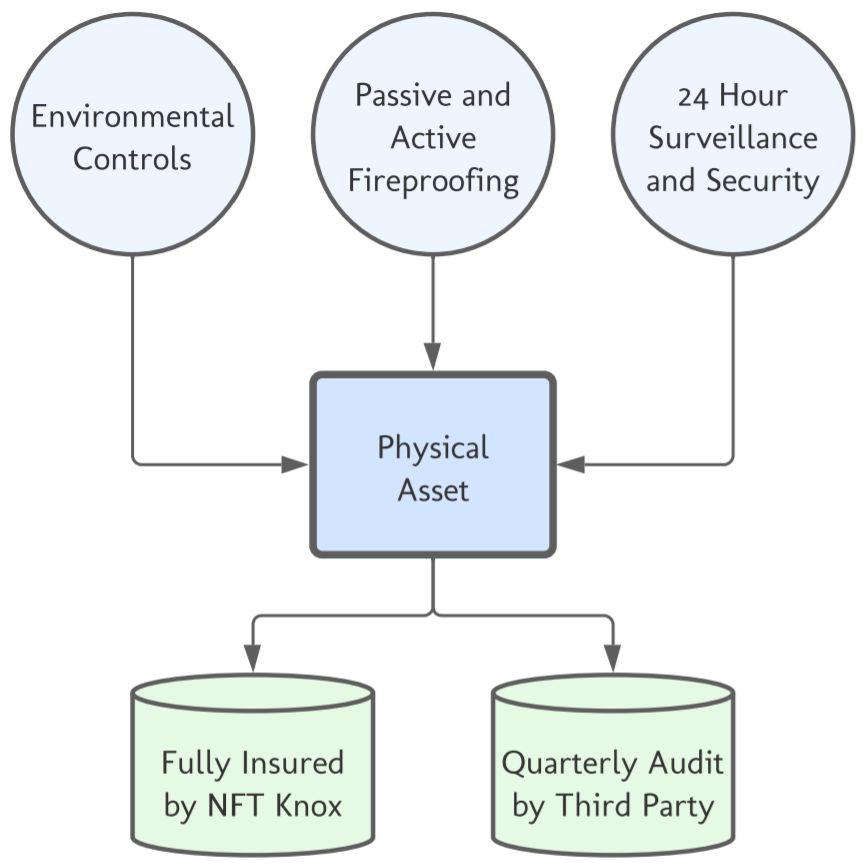

The physical assets entrusted to NFT Knox hold immense emotional, financial, and sentimental value. That's why our security and insurance procedures are meticulously designed to match the significance of these assets.

We understand the importance of preserving these assets, and we take every measure to ensure their safety. Our storage facilities provide optimal conditions, protecting against temperature, humidity, and UV damage. We have implemented both active and passive fire protection measures to safeguard against any unforeseen incidents. Our commitment to security goes beyond standard practices, with enhanced measures in place to provide an additional layer of protection.

When it comes to the physical security of our facilities, we leave no stone unturned. Our assets are under 24-hour monitoring, and we have redundant security systems in place to maintain constant vigilance. While the exact location of our secured assets remains undisclosed for security purposes, we prioritize transparency by engaging in routine third-party audits of our entire inventory. This ensures that our clients can have complete confidence in our storage process.

In the unlikely event that the unthinkable happens, our clients can rest assured knowing that their assets are fully insured. We guarantee the value of each asset for as long as it remains under our care and preservation. Our comprehensive insurance coverage provides an added layer of protection, offering peace of mind to our clients and their valuable possessions.

REDEMPTION OF THE ASSET

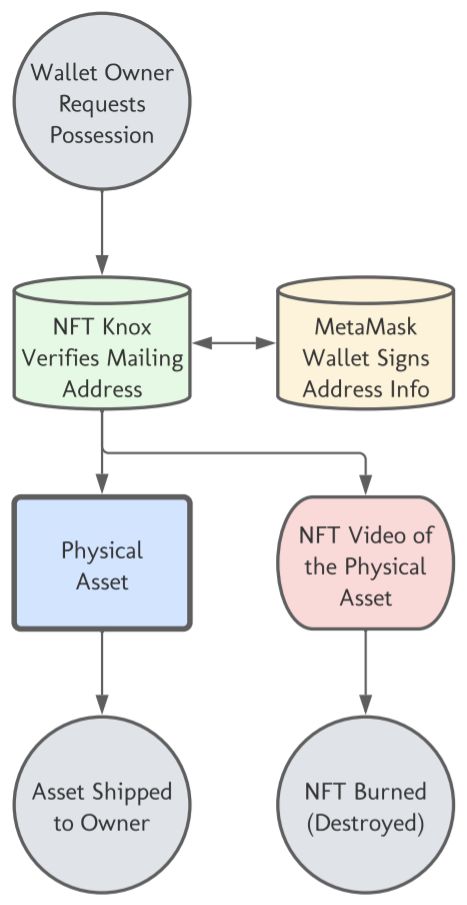

Redeeming your physical asset through NFT Knox is a straightforward process. As the sole owner of an Asset-Backed NFT, you have the power to initiate the redemption operation. Simply transfer your NFT to the NFT Knox redemption wallet, and we will effortlessly verify the integrity of your submitted mailing address using our advanced cryptodiagramic technology.

To ensure added security, we will also send you an email requesting the completion of the same signature process. This step ensures that we have your most up-to-date mailing address for the pending redemption. We believe in providing a transparent and streamlined experience for all parties involved.

Once the redemption process is successfully completed, the NFT associated with the redeemed asset will be burned (destroyed) through our automated process. However, if you choose to reintroduce the asset into the NFT Knox platform, ship it to one of our facilities, and restart the cycle, we will create a newly minted NFT for you.

At NFT Knox, we prioritize simplicity and convenience. Redeeming your physical asset is a hassle-free process that puts you in control. Experience the ease of our redemption process and enjoy the benefits of secure asset ownership with NFT Knox.

FINANCIAL MECHANICS

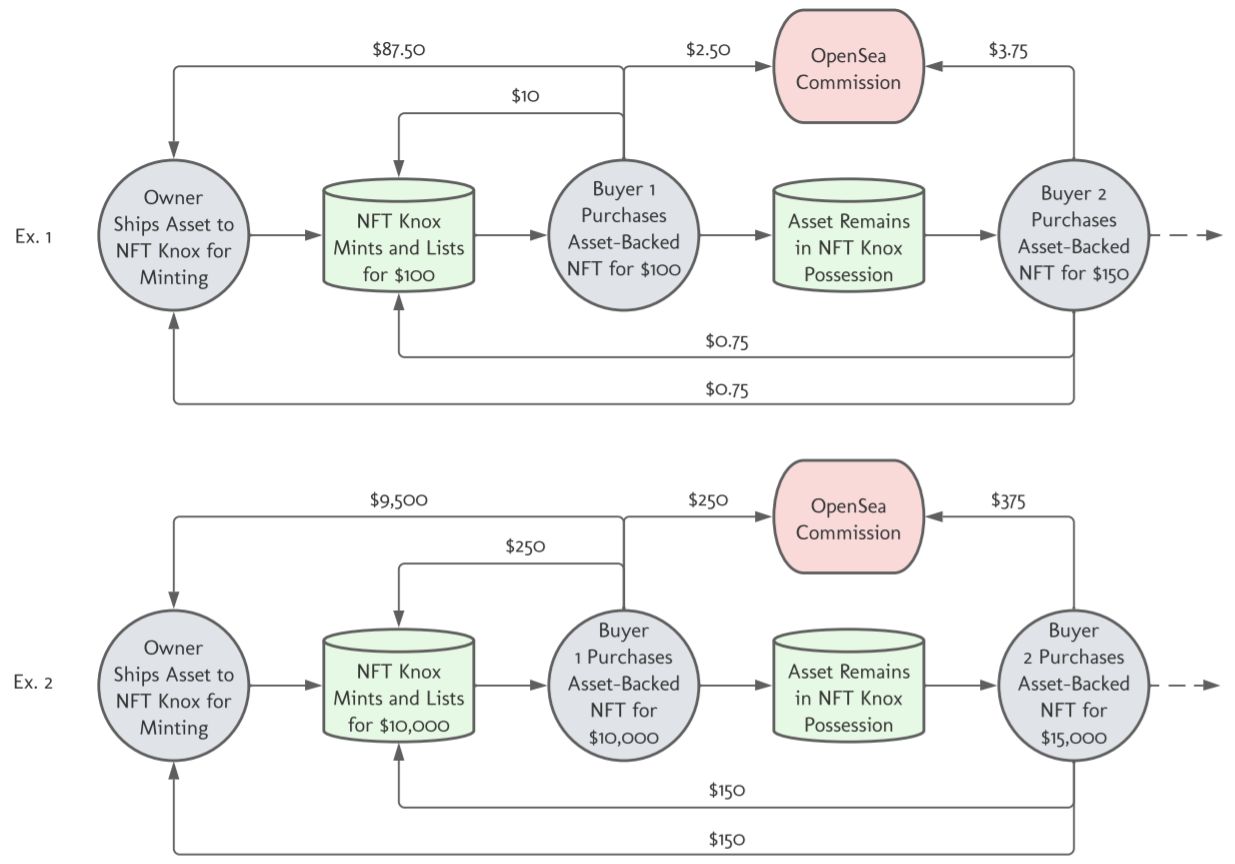

For every NFT sold through our minting process, NFT Knox takes a specific percentage of commission:

Value of Asset

- $1 to $100 USD10%

- $100.01 to $500 USD7.5%

- $500.01 to $2000 USD5%

- $2000.01 and greater2.5%

This is in addition to a 2.5% commission charged by OpenSea on every sale.

On subsequent sales, while the asset remains in NFT Knox’s possession without redemption, a 1% commission is charged on each transaction and awarded to the original minting owner as well as NFT Knox. This is once again in addition to a 2.5% commission charged by OpenSea.

Shipping and carrier insurance costs when delivering the asset to NFT Knox are the sole responsibility of the asset owner.

At the time of redemption, shipping costs are addressed in the following manner:

- US-based address MATIC equivalent of $25 USD plus insurance through carrier

- Non-US-based addressContact support@nftknox.com

TECHNOLOGY

NFT Knox offers a unique and versatile platform that connects NFTs to tangible assets. Our platform is designed to be scalable and adaptable, allowing for easy integration with blockchain technology and third-party NFT marketplaces.

The platform is built with two main components. The backend framework utilizes Python, commercial cloud services, and API integration to ensure smooth operations. The frontend, written in HTML, CSS, and Javascript, provides a user-friendly interface. One crucial aspect of the frontend is our signature process, which interacts with MetaMask to digitally sign and register ownership of the NFT and asset. This digital signature plays a vital role in the verification and redemption process.

At NFT Knox, we are not limited to the digital realm. Our goal is to bridge the gap between physical assets and digital representations. By doing so, we enhance authenticity and simplify the buying and selling process for high-value physical assets. We believe that our Asset-Backed NFTs are a groundbreaking application of NFT technology in the real world..

CONTACT

Continue your research or join us on our social media accounts:

- Website:nftknox.com

- Twitter: @theNFTknox

- Medium: @NFTknox

- Instagram: @thenftknox

DISCLAIMER

Please note that the information provided in this document is for informational purposes only and is subject to change or update without prior notice. It should not be interpreted as a commitment or guarantee by NFT Knox. By accepting this document, the recipient acknowledges that all information contained within it or provided in connection with the offering is confidential and nonpublic. The recipient agrees to maintain the confidentiality of this information and not to use it for personal gain, except in relation to their own investment decision-making.

However, it is important to understand that the recipient's obligation to maintain confidentiality does not extend to information that is already in the public domain. Any user should carefully evaluate their investment decision based on independent assessments of the financial condition and other relevant factors. It is crucial not to solely rely on the information presented in this document when making investment decisions.